Cities of Innovation: Sheffield

Key indicators

ICT Infrastructure

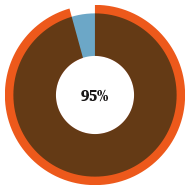

Properties with superfast broadband

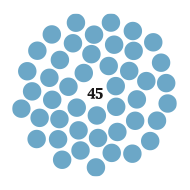

Average broadband speed (Mbps)

— 22 million project to increase the provision of ultrafast broadband — Gigabit fibre connectivity for enterprise zones and key business parks — 220 wi-fi access points will offer the public download speeds of 20 Mbps

Local, national and international transport links

Flight destinations

Sheffield Doncaster: 1.33 million passengers

Manchester airport

— 75% of the UK can be reached within a 4.5-hour HGV drive — Daily freight services connect Felixstowe and Southampton with Doncaster railport. London is only 90 minutes by train from key stations in the region

University links and access to talent

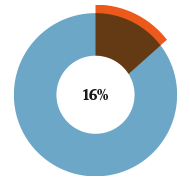

QS World University ranking

Sheffield University

Number of graduates increase

— 12 universities within a 60 minute travel time, providing a catchment of 313,000 students and 92,000 graduates each year 30% of the Sheffield workforce is under 30 years old 10,000 international students from 25 countries

Costs and availability of workspace

Premium commercial space

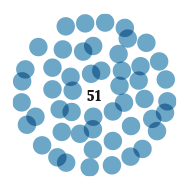

Co-working spaces

— Premium commercial space at €30 ft2 per annum — 51 co-working spaces with the global brand Regus

City support for start-ups and SMEs

Events

Business support

— Business Sheffield provides help from Business, Growth and Tech Scale-up Advisors to identify market opportunities and introduce investment. It is supported by a university-led programme which provides up to 12 days free support to research or develop a product

Financial support and access to investors & accelerators

Investors

Accelerators

— €57 million Business Investment Fund and €18.5 million invested through the Skills Bank — Sheffield will soon host its first Investor Ladder event to attract a large number of Angel Syndicates, VCs, Investment Banks and early stage PE houses

Additional information

ICT Infrastructure

In addition to Superfast South Yorkshire, Easynet, ASK4, Level 3 and SSE Telecom have all invested to develop infrastructure. Superfast broadband will be in 99% of properties by 2021.

Local, national and international transport links

Sheffield is one of the top two connected core cities in the UK, with Leeds, Manchester, Birmingham and Nottingham less than an hour away, and London a further two hours away. The High Speed Rail (HS2) link should further reduce the journey time to Manchester.

There are six international airports within a 90-minute drive. A unique, pioneering tram- train, as well as regular trams and buses is supported by car-sharing in the form of the Enterprise Car Club, which offers hourly and daily vehicle hire from eight locations around Sheffield.

University links and access to talent

Sheffield boasts world-class universities. The University of Sheffield is a member of the Russell Group of leading UK research universities, and offers expertise in cybersecurity, data analytics, machine learning and AI. The Advanced Manufacturing and Research Centre (AMRC) is also based at the University of Sheffield. Within AMRC is Factory 2050, the UK’s first state-of the-art factory, conducting collaborative research into reconfigurable digitally assisted assembly, component manufacturing and machining technologies.

Sheffield Hallam University has 63,000 students, and produces 20,000 graduates per year – 93% of whom are employed within six months of graduation. Its research programme was ranked in the top five of all UK modern universities in the National Research Excellence Framework (REF) 2014. The world’s largest Playstation lab also resides at Sheffield Hallam. There are numerous collaborations with the digital and medical sectors.

Sheffield City Region (SCR) Enterprise Zone is a collaboration between the university and industry (Boeing, McLaren Automotive, Rolls- Royce, Aloca, Tata, Outokumpu and Forgemasters).

Sheffield has an ambitious and expanding digital tech sector. In September 2016, there were 5,495 technology companies across the Sheffield City Region, the largest 25 of which has a turnover of just under £2b, employing 12,657 people.

Sheffield and Rotherham were identified in the Tech Nation 2017 report as one of seven tech clusters in the North of England.

Salaries have grown by 13% since 2011, the joint second-fastest growth of the eight English core cities.

Costs and availability of workspace

Sheffield has seen the opening up of significant commercial spaces that have been either designed specifically for creative and digital firms, or simply adopted by companies in this field. Spaces such as Harland Works, Globe Works, the Workstation, Electric Works, Krynkl, Little Kelham and Park Hill, amongst a range of others, have provided a range of property options for growing businesses of various sizes and budgets.

City office development

Heart of the City II is one of Sheffield’s key economic projects. Backed by Sheffield City Council alongside its strategic delivery partner Queensberry, the scheme will provide a dynamic and vibrant mixed-use district in the heart of the city centre.

Other office spaces are being developed in the form of Vidrio, 4 St Pauls, and West Bar Square.

City support for start-ups and SMEs

In addition to support from Business Sheffield, new businesses will find guidance from Rotherham Investment Development Office (RiDO), Barnsley Business & Innovation Centres and University of Sheffield Innovation.

Sheffield’s Tech Hub, Kollider functions as an accelerator, incubation space, co working space and office spaces. Working with Barclays Eagle Labs they plan to offer a range of events and services to growing tech businesses.

A Startup Weekend runs annually in Sheffield.

Sheffield’s digital coalition, dot. SHF, was nominated for a Digital Leader award in the category Cross-Sectoral Collaboration. dotSHF brings digital leaders and practitioners together to share what they do across seven key city domains. There are 50 active tech and creative meetups in and around Sheffield.

Sheffield is home to the ‘Last Friday Klub’; a monthly event delivered by Kollider and bringing together bespoke training and support for high-growth companies. This includes one-to-one technical support and an opportunity to talk with and pitch to seed investors.

Participants at the Last Friday Klub have included Accelerated Digital Ventures (ADV), Angel Groups, Mercia Technologies, Foresight Group and Northern Powerhouse Investment Fund.

Financial support and access to investors & accelerators

Typical incentives are focused around production and experimental capex, R&D, skills, relocation, recruitment, enterprise zones and property. This is underpinned with delegated funds from government, including €57m of the Business Investment Fund and €18.5m invested through the Skills Bank, which provides match funding for businesses up-skilling their workforce.

Accelerators include: Y-Accelerator and Dotforge.

How to set up a business: a quickfire guide

What are my options?

While there are numerous business forms, the most common initial start-up structures are as a sole trader and or a private company limited by shares.

A sole trader is the simplest structure as the individual does not need to register the company with a formal constitution. Sole traders enjoy minimal paperwork and benefit from the flexibility of moulding their business plan without consulting shareholders. The downfall of this structure is that sole traders are personally liable for all the debts and contractual obligations of the business.

Private companies limited by shares give a business its own legal personality. This means that the business owners are not personally liable for the company’s debts. Companies with this structure are also able to raise capital more easily due to tax incentives and greater credibility as a result of a company’s professional image. Although this structure comes with additional paperwork, the UK’s efficient online company system has made the submission of paperwork a relatively simply task.

What do I need to set up a company?

To incorporate a company, an individual needs to submit the following:

Company name: this must not be too similar to another registered name.

Registered address: you must provide a UK office address as the address to which all business letters and invoices are sent. While there needs to be a registered address in the UK, an international director does not need to be present at the address. The director only needs to ensure that it is a physical address from where they can receive mail. Many businesses use their accountant’s address where post can then be forwarded to the director or managed by the accountant itself.

Director: the name of at least one director. Directors need to be at least 16 years old. Directors do not need to reside in or even have visited the UK. Shares: the details of share capital with at least one initial shareholder.

Company documents: a Memorandum and Articles of Association are the legal documents which confirm company formation and dictate the rules by which the company will be run. While these may seem daunting, the UK government’s website (gov.uk) has a memorandum template and model articles which a director may copy and complete easily and quickly for submission.

How much does it cost?

The entire online registration process costs £12 (€14) and it takes up to 24 hours for the company to be registered.

Tax rates

Following registration, the company will be subject to a 19% tax rate on company profits. Additionally, the company may be liable to pay VAT if its taxable turnover exceeds £85,000 annually. VAT rates vary depending on services or goods rendered with the maximum VAT rate being 20%.

The UK government strongly supports start-ups and offers various tax relief and support schemes. Tax relief is usually possible on spending that is entirely for business use such as certain business travel or machinery. R&D tax credits are available to businesses which are working to advance science or technology. A company that profits from its patented invention could also benefit from Patent Box in which corporation tax is lowered from 19% to 10%.

Small businesses can also benefit from the Seed Enterprise Investment Scheme which offers both income and capital gains tax relief to the company’s investors.

To raise further capital, the government arm Innovate UK drives growth by supporting UK- based businesses through funding. To date, the scheme has invested around £2.5 billion. Businesses may participate through regular innovation competitions, which focus on different sectors.

Legal contact

Electra Japonas and Kaveesha Thayalan

The Law Boutique

Work.Life, The Law Boutique, 5 Tanner St, Bermondsey, London SE1 3LE