Cities of Innovation: London

Key indicators

ICT Infrastructure

Average broadband speed

Mbps (96% of companies)

Data centre ranking

The UK government announced in 2018 a new national broadband voucher programme for SMEs, setting aside £67 million (€76 million) to fund ultra-fast broadband connections. SMEs and surrounding local communities can use the scheme to claim £2,500 against the cost of installing gigabit-ready connections

Local, national and international transport links

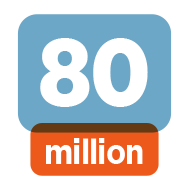

Airport passengers

Heathrow, per year

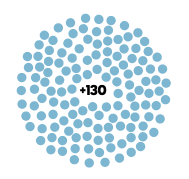

Flight destinations

6 Airports (Heathrow, Stansted, Gatwick, London City, Luton and Southend) covering 396 destinations — Eurostar: 1hr 51mins from Brussels & 2hr 15mins from Paris — 8 main train stations connecting London to all parts of the country

Universities and access to talent

Top 40 ranked universities

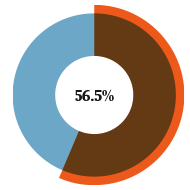

Degree-educated workforce

Four colleges in the top 40 of the 2019 Times Higher Education World University Rankings — UCL is top ranked at 7th in the QS University ranking. Imperial College is top ranked 9th in the Times HES ranking — 37 % of population is foreign born

Cost and availability of workspace

Average city centre rates

WeWork space in Waterloo (ft2)

Prime rents (ft2/annum): · Canary Wharf €55 | Croydon €40 · Hammersmith €65 · King’s Cross €95 | The City €80 — Flexible office space rents (month) · Canary Wharf €680-€1000 · Shoreditch €680-€1000 · Stratford €450 - €650 · The City €630-€1375

City support for start-ups/SMEs

Grant for start-ups

Mayor’s Civic Innovation Programme

TechInvest Challenge

Capital for start-ups. — London & Partner programmes: · Set up and grow in London – Free of charge advice (see invest. london) · Business Growth Programme (see businessgrowth.london) · The Mayor’s International Business programme – mentoring and trade missions for overseas expansion (see gotogrow.london)

Financial support and access to investors & accelerators

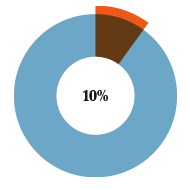

Tax rate for patent profits

R&D expenditure tax deduction

— Deduction of 230% of qualifying R&D expenditure for SME’s — SMEs with tax losses can claim a cash credit of up to £33.35 for every £100 spent on R&D — 30% and 50% tax break for individuals investing in early stage start-ups

Additional information

Local, national and international transport links

London Underground – The Underground (Tube) is divided into nine zones which have a range of different fares. The easiest way to travel on the Tube is to use an Oyster card or contactless bank card to tap in and out of stations.

National Rail – Trains offer transport across London and are useful to reach places that do not have the Underground.

Bus – Iconic red, double decker buses ride around London via their own bus lanes. Payment can be made with an Oyster card or contactless bank card.

Cabs – London’s traditional and iconic black cabs are available all around London. They can be hailed when they have their yellow light on show. London black cabs are able to travel in bus lanes, reducing travel time. Payment can be made with cash or card. There are also licensed minicab and ride hailing services.

Bicycle – There are lots of cycle lanes in London. Santander Cycle Hire (the city’s official cycle hire scheme) has various docking locations to hire bicycles. The hire process is easy using your debit

or credit card as payment, but if you are after a quick cycle the first 30 minutes are free. This system is further augmented by dockless bicycle hire schemes.

Key innovation and regeneration areas, with major examples listed below, are well connected by various modes of transport:

— Kings Cross (central London) – major rail stations at Kings Cross and St Pancras (with regional, national and international connections), supported by various underground lines and extensive bus connections. This is a prime example of transit-oriented regeneration.

— Queen Elizabeth Olympic Park (East London) – major rail stations at Stratford Regional and Stratford International, supported by underground, DLR (Docklands Light Rail), London Overground and extensive bus connections.

— Shoreditch (a major tech hub in central/East London) – major rail station at Liverpool Street, supported by various underground, overground and extensive bus connections.

— White City (West London) – multiple underground, overground and bus connections.

— Croydon (tech hub in South London) – good train, tram and bus links, including 15 minutes to central London by fast train.

Additional information on innovative and shared ways of transportation:

The Mayor of London has an ambitious plan to make London carbon neutral by 2050. This has resulted in an ambitious transport strategy to achieve 80% of journeys to be on foot, cycling or public transport by 2041, as well as the largest electric bus fleet in Europe by 2041, as well as the largest electric bus fleet in Europe. An industry-wide Taskforce has been launched to expand charging infrastructure for EVs, and, all new taxis are now required to be zero emission capable. London is also the lead city for C40 on zero emission vehicles.

There are now almost 12,000 electric vehicles registered in London, with 1,869 charging points across the city, and a further 1,500 planned for installation. Additionally, an Ultra Low Emission Zone implemented in April 2019, is making drivers meet new, tighter emission standards or pay a daily charge to travel within central London.

University links and access to talent

Many universities run dedicated programmes and initiatives to encourage innovation and spin out new businesses as a result. There are also many examples of collaboration between academia and industry, with a few outlined below:

— Plexal: running the London Cyber Innovation Centre – a £13.5 million initiative to bring industry, researchers

and investors together to boost the UK’s position as a place to develop cyber security technology. It is funded by the Department for Digital, Culture, Media and Sport as part of the Government’s five-year, £1.9 billion cyber programme.

— MedCity: MedCity connects international companies and researchers with talent and public and private investment. Centering on London, Oxford and Cambridge, MedCity is an ecosystem for businesses and investors keen to understand, access, collaborate and invest in life sciences.

— Imperial White City Incubator: A hub for innovation and entrepreneurship, providing office and laboratory space for early-stage companies. Early-stage businesses can take advantage of being in close proximity to eminent scientists and experts in technology.

— Accelerator London: Originally launched with London Metropolitan University, Accelerator is one of the oldest programmes in London, and offers private offices and hot-desking within an active community of start-ups.

— FFWD: Established by City University London, in conjunction with Accelerator Academy. Delivered in one-day sprints, over a six-week period, this interactive, hands-on programme is designed to cover key topics such as Tech, Marketing, Finance, and much more, using a blend of expert speakers and professional industry mentors.

— Enterprise Hub: The Royal Academy of Engineers’ Enterprise Hub provides up to £60,000 equity-free, grant funding, as well as a year-long programme of training and mentoring for researchers who are looking to spin out a technology business and recent graduates who are looking to bring their innovation to market. The programme supports engineers to become entrepreneurs, but defines ‘engineering’ in the broadest sense, from AI to construction.

— The Francis Crick Institute: The Francis Crick Institute is a biomedical research centre in London, which opened in 2016. The institute is a partnership between Cancer Research UK, Imperial College London, King’s College London, the Medical Research Council, University College London and the Wellcome Trust. With 1,250 scientists and an annual budget of over £100 million, the institute is the biggest single biomedical laboratory in Europe. The Institute actively develops and promotes new partnerships with the broader scientific and medical community, bringing together the best minds from research, academia and industry.

— Alan Turing Institute: The Alan Turing Institute is the UK’s national institute for data science and artificial intelligence. Founded in 2015, it is named after Alan Turing, the British mathematician and computing pioneer. Its mission is to make great leaps in research, tackling some of the biggest challenges in science, society and the economy. The institute collaborates with universities, businesses and public and third sector organisations to apply this research to real-world problems.

Access to talent 25% of all UK graduates work in London. With 37% of the London population being foreign born, London also provides access to an unrivalled diversity of human capital.

The workforce in London is hugely international and it is a desirable city for global professionals to relocate to. 89% of non-British nationals surveyed in 2017 considered the UK an attractive destination to live and work. International talent is attracted to London for the city’s rich cultural heritage, world- class museums and cultural institutions and diverse cultures and languages.

Recent research from LinkedIn based on analysis of its European members, showed that London continues to be a major draw for international tech talent, with the UK capital welcoming more European and non-EU tech professionals looking to live and work outside their own country than any other major European city in 2017.

Total number employed by sector / percentage of workforce by sector

— Primary and Utilities 28,500 / 1%

— Manufacturing 109,000 / 2%

— Construction 204,000 / 4%

— Wholesale 194,000 / 4%

— Retail 415,000 / 8%

— Transport and Storage 236,000 / 5%

— Accommodation and Food Services 386,000 / 8%

— Information and Communication 417,000 / 8%

— Finance and Insurance 367,000 / 7%

— Professional, Real Estate, Scientific and Technical 788,000 / 15%

— Administrative and Support Services 574,000 / 11%

— Public Administration and Defence 215,000 / 4%

— Education 399,000 / 8%

— Health and Social Work 545,000 / 11%

— Arts, Entertainment and Recreation 140,000 / 3%

— Other Services 116,000 / 2%

Costs and availability of workspace

As of September 2018, the level of office construction activity across central London totalled 11.8 million square feet, 73% being new builds. In the six months up to September 2018, there were 32 new office builds. Overall, London office availability saw another uplift to 16.2 million square feet by the end of Q3 2018, up by 5% year on year.

London has an abundance of high quality co-working, start-up and grow-on spaces. There are 177 incubators and accelerators in London, supporting thousands of businesses a year. In fact, London is the largest city in the world for co-working, with WeWork being London’s biggest private user of office space – its new 280,000 sq ft co-working space in Waterloo is set to be the largest in the world.

City support for start-ups and SMEs

The Mayor of London supports innovation and access to finance directly though several flagship programmes. See infographic.

There are also business support opportunities available through the LEAP – the local enterprise partnership for London, such as the London Growth Hub: this is an online signposting tool helping connect London’s entrepreneurs, microbusiness and SMEs with the support that is available to help them start, sustain and grow. It brings together the capital’s vast business support offer into a single online resource which is supplemented by a programme of face-to-face business support, including business to business mentoring, a Meet the Buyer programme and a Property Advice Service.

Other strategic and funding initiatives led by LEAP to support London’s businesses include the overseeing of £160m in investment to fund businesses, encourage innovation and support and deliver regeneration.

Financial support and access to investors & accelerators

LEAP also provides funding.

— Good Growth Fund: this is a £70 million regeneration programme to support growth and community development in London. The fund is currently open to applications and will support projects that are inclusive, innovative and which demonstrate an outstanding approach to challenges faced across London, focused on driving regeneration.

— Business Air Quality Fund: LEAP has invested £1m to establish the Mayor’s Business Air Quality Fund, which will provide grants of up to £200,000 to businesses/business groups to deliver Business Low Emission Neighbourhood to reduce pollution on high streets, around offices or within retail parks.

— Digital Talent Programme: this £7m programme will offer training opportunities for young people and will focus on supporting women’s and ethnic minority groups to gain the skills needed to find employment within London’s digital, technology and creative sectors.

— London Co-Investment Fund: this is an £85m fund to support more than 150 science, technology or digital companies based in London and demonstrably committed to creating jobs in the capital.

— Crowdfund London: the Mayor of London has announced a new round of Crowdfund London, which offers funding of up to £50,000 from the LEAP offered to match crowdfunding campaigns launched by organisations seeking to deliver civic improvement projects.

The UK also provides financial incentives:

— EIS and SEIS: Generous tax incentives for investors known as the Enterprise Investment Scheme, and the Seed Enterprise Investment Scheme. These offer a 30% and 50% tax break for individuals investing in early stage start-ups, considerably reducing the risk to investors of supporting tech start-ups.

— Film/creative industries: the UK has introduced certain film tax and creative sector (e.g. television and video games industry) reliefs that may provide tax credits for certain qualifying expenditure of these industries.

— Intellectual property: the UK has an established tax regime associated with the taxation of intellectual property – in some cases tax deductions for amortisation of certain acquired intangible assets may be available.

— The UK Patent Box allows companies to elect to apply a 10% Corporation Tax rate to all profits attributable to qualifying patents.

— Share incentive arrangements: these can be implemented as part of an individual’s total remuneration package.

— Personal tax reliefs: these may be available in some cases to expats be- ing relocated to the UK and to short term business visitors to the UK.

Main accelerators

— Barclays Accelerator: FinTech accelerator powered by Techstars

— Bethnal Green Ventures: A Tech for Good programme

— Breed Reply: Funds and supports Internet of Things startups

— Campus London: Google’s space for entrepreneurs

— Central Working: Your business is more than just a job, this is more than just an office

— Collider: Accelerator dedicated to marketing & adtech startups

— CyLon: World-leading cybersecurity accelerator

— GCHQ Cyber: Accelerator Developing the UK’s cybersecurity ecosystem through accelerating innovative startups

— IDEALondon: UCL and Cisco run Post Accelerator

— Impact Hub: For social entrepreneurship

— Innovation Warehouse: For entrepreneurs working on high growth, high impact startup businesses

— JLAB: John Lewis technology incubator

— Launch22: Helps early stage entrepreneurs grow their enterprise

— LawTech Eagle Lab

— Level39: Europe’s largest technology accelerator space for finance, retail, cyber and future cities technology companies

— LORCA – the London Office of Rapid Cybersecurity Advancement

— MassChallenge: The most startup- friendly accelerator on the planet

— The Mayor of London’s Civic Innovation Challenge

— The Mayor of London’s TechInvest Programme

— Microsoft Ventures – Seven accelerators around the world. 12- week programme

— Plexal: Europe’s largest innovation ecosystem on the site of London’s Queen Elizabeth Olympic Park

— Rise: FinTech community of rising startups and industry leaders

— Rocketspace: Co-working space for high-growth startups

— Seedcamp

— Startupbootcamp: For global startups

— TechHub: Spaces around the world for tech entrepreneurs to meet, work, learn and collaborate

— Techstars: Global ecosystem for entrepreneurs

— The Bakery: The world’s first AdTech accelerator

— The Trampery: Spaces for entrepreneurship, creativity and innovation

— TrueStart: Retail and fashion accelerator

— Wayra: Telefonica’s startup accelerator programme includes Wayra UnLtd

— White Bear Yard: Hub for new startup and digital technology and media companies

How to set up a business: a quickfire guide

What are my options?

While there are numerous business forms, the most common initial start-up structures are as a sole trader and or a private company limited by shares.

A sole trader is the simplest structure as the individual does not need to register the company with a formal constitution. Sole traders enjoy minimal paperwork and benefit from the flexibility of moulding their business plan without consulting shareholders. The downfall of this structure is that sole traders are personally liable for all the debts and contractual obligations of the business.

What do I need to set up a company?

To incorporate a company, an individual needs to submit the following:

Company name: this must not be too similar to another registered name.

Registered address: you must provide a UK office address as the address to which all business letters and invoices are sent. While there needs to be a registered address in the UK, an international director does not need to be present at the address. The director only needs to ensure that it is a physical address from where they can receive mail. Many businesses use their accountant’s address where post can then be forwarded to the director or managed by the accountant itself.

Director: the name of at least one director. Directors need to be at least 16 years old. Directors do not need to reside in or even have visited the UK. Shares: the details of share capital with at least one initial shareholder.

Company documents: a Memorandum and Articles of Association are the legal documents which confirm company formation and dictate the rules by which the company will be run. While these may seem daunting, the UK government’s website (gov.uk) has a memorandum template and model articles which a director may copy and complete easily and quickly for submission.

How much does it cost?

The entire online registration process costs £12 (€14) and it takes up to 24 hours for the company to be registered.

Tax rates

Following registration, the company will be subject to a 19% tax rate on company profits. Additionally, the company may be liable to pay VAT if its taxable turnover exceeds £85,000 annually. VAT rates vary depending on services or goods rendered with the maximum VAT rate being 20%.

The UK government strongly supports start-ups and offers various tax relief and support schemes. Tax relief is usually possible on spending that is entirely for business use such as certain business travel or machinery. R&D tax credits are available to businesses which are working to advance science or technology. A company that profits from its patented invention could also benefit from Patent Box in which corporation tax is lowered from 19% to 10%.

Small businesses can also benefit from the Seed Enterprise Investment Scheme which offers both income and capital gains tax relief to the company’s investors.

To raise further capital, the government arm Innovate UK drives growth by supporting UK- based businesses through funding. To date, the scheme has invested around £2.5 billion. Businesses may participate through regular innovation competitions, which focus on different sectors.

Legal contact

Electra Japonas and Kaveesha Thayalan

The Law Boutique

Work.Life, The Law Boutique, 5 Tanner St, Bermondsey, London SE1 3LE