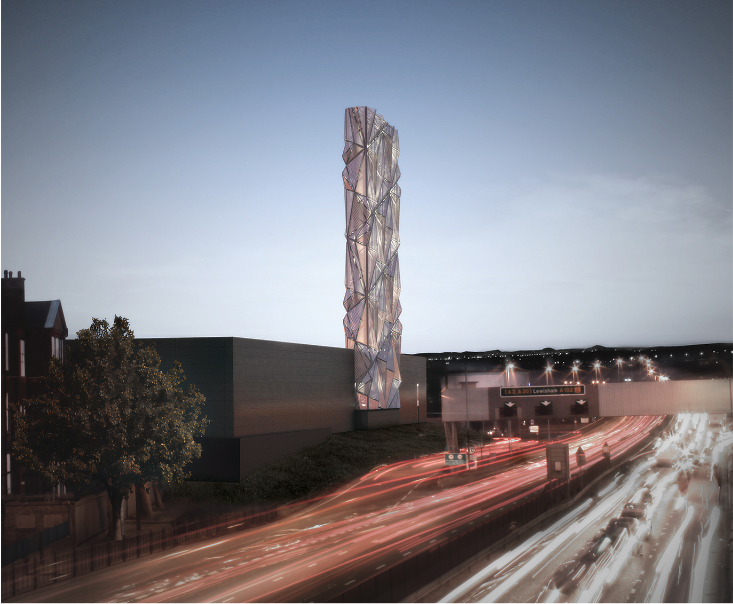

Photo: GPEL-En-Centre

London funding model for energy efficiency ready for national rollout

24 February 2016

by Steve Hoare

Specialist infrastructure fund manager Amber Infrastructure has completed the initial funding cycle of the London Energy Efficiency Fund with a model it hopes can be rolled out to other cities throughout the UK.

Amber’s sustainable capital arm Amber Green has invested over £65 million of public funds to improve energy efficiency in over 76 public and private buildings across nine London boroughs.

“Other cities [such as Manchester] are considering a low carbon fund,” said Leo Bedford, Director of Amber Green. “Of course, we would be interested in using our experience with London to help them.”

LEEF is part of the European Commission’s Joint European Support for Sustainable Investment in City Areas (JESSICA) initiative and has helped pioneer the Mayor of London’s urban regeneration agenda.

It was part of the mayor’s 2020 Low Carbon plan and is funded through £65 million of public investment from the European Regional Development Fund (ERDF), the Mayor of London and London Waste and Recycling Board and up to £50 million from The Royal Bank of Scotland (RBS). Amber claims to be the largest private sector asset manager of ERDF monies.

Bedford explained that a city or geographical area needs to be a certain size to justify a similar fund of £40 to 50 million.

“Part of the reason for funds like LEEF is because there is a funding gap for sustainable development projects,” he said. “Banks are still not comfortable with the development risk of green projects. ‘Spend to save’ is a difficult thing to get financing for. There is a disappointing paucity of energy efficiency projects in the UK.”

“There is a lot of opportunity but not a lot of willingness to finance projects. It needs this type of concessionary funding to unlock that latency in the market so sponsors and banks can see that it works.”

The recent deployment of a £14.5 million loan agreement to finance the installation and operation of an energy efficiency heat network for 15,000 new homes in London’s newest residential district, Greenwich Peninsula, marks the completion of LEEF’s initial funding cycle.

Since 2011, LEEF’s investments have supported 1,600 construction and operational jobs and will reduce CO2 emissions by 35,000 tonnes in London–the equivalent of removing 32,000 cars from the road.

LEEF will continue to re-invest recycled capital generated from the returns on initial seed investments maturing over the course of the next investment cycle to August 2018.

In total, LEEF’s investments have enabled £470 million of projects throughout London, including:

- a £20 million investment to the Tate Foundation for the installation of low-carbon heat and cooling systems across the Tate’s London estate;

- £12 million to St. George’s Hospital to cut energy output by 39 percent and reduce carbon emissions by 6,000 tonnes per annum;

- £6 million to the London Borough of Enfield for the Lee Valley Heat Network designed to heat and distribute water to over 6,800 homes and businesses;

- £4.7 million to the Salters Livery Company for a series of energy system upgrades which will reduce consumption by 39 percent;

- £4.6 million for communal heating networks across ten housing blocks in the London Borough of Hackney, reducing energy bills by around 56 percent and securing average savings of £980 for over 1,500 tenants; and

- £3.5 million committed to London Borough of Croydon to fund an authority wide RE:FIT scheme installing energy saving infrastructure to reduce carbon emissions and helping Croydon to reach its 25 percent reduction target by 2015.

Bedford continued: “Since 2011, we have seen a huge rise in demand from public and private sector landlords in London to make the residential and commercial real estate they own and manage more energy efficient.”