Cities of Innovation: Prague

Key indicators

ICT Infrastructure

Average broadband speed (Mbps)

Network coverage

Local, national and international transport links

Global destinations (17 million passengers per year)

Journey to Berlin

— Linked to the European railway network for people and cargo

University links and access to talent

Business areas workforce

QS World University ranking (Charles University)

— 41 higher education institutions in Prague, including public, state and private universities — 327,000 students

Costs and availability of workspace

Average cost of office rent

Co-working spaces

— Co-working spaces in Prague: · Hot Desk/Open Plan Seating: €135 month · Dedicated desk, monthly rent: €174 month · Private office, monthly rent: €270 month

City support for start-ups and SMEs

Special events

Oganisations

— Regional Innovation Strategy introduces tools and concepts for boosting the innovation in the city. It ended up in the Action plan of Economic Diplomacy to help start-ups with entering global markets and vice versa.

Financial support and access to investors & accelerators

Incubators

Programme

— The Prague Vouchers programme helps start-ups in 6 specific fields: innovation projects, creative services, coaching and mentoring, global incubators and international fairs — Two start-up incubators are run by Prague City Hall: Prague Startup Centre and ESA BIC

Additional information

Local, national and international transport links

Vaclav Havel International airport has many international flights, including London (2 hours), Berlin (55 minutes), Moscow (2 hours 45 minutes), and Dubai (6 hours).

The Sustainable Cities Mobility Index 2017 report placed Prague in the fifth place for its public transport. Prague has a metro, tramways, urban/suburban buses, railway, funiculars and ferries, all used by more than 1.2 billion passengers annually. There is also a car-sharing option.

University links and access to talent

Charles University has a subsidiary, in the form of the limited liability company Charles University Innovations Prague s.r.o. (CUIP). The purpose of the company is to transfer knowledge and technologies generated at Charles University to real life. The partner of CUIP is the Centre for Knowledge and Technology Transfer of the Charles University (CKTT) and the two organisations closely cooperate in this area.

Prague City Hall operates a communication platform which connects the public sector, academic sector, R&D, StartUps and SMEs.

City Hall also runs an online platform for boosting innovation, called Innovation market, which aims to enable easier access for entrepreneurs to find and address research capacities. Currently it lists more than 80 projects and 90 research centres.

There is a lack of specialised professionals in the local market, and so talent is frequently sought from abroad. Technical and IT- related sectors employ a large percentage of foreign workers. The administrative process to recruit and employ foreign specialists can sometimes be slow.

Business areas

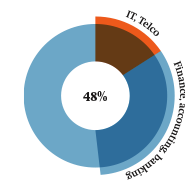

Finance, accounting, banking – 30% of the workforce, IT, Telco – 18% of the workforce.

City support for start-ups and SMEs

The Prague City Hall continuously supports organisation of events focused on start-ups, where the starting companies can absorb know-how or network with their peers, companies or investors. Recently, a hackathon was held, which focused specifically on bringing innovation to the public services sector.

Operator ICT, the city-owned organisation, which is responsible of the smart city projects in Prague, organised the Smart Prague Hack Fest 2018.

The incubator, Prague Startup Centre is also very active in organising events for start-ups – from business breakfasts and networking events, to practical workshops.

Adjoining the Prague Startup Centre, the Prague Startup Market has been established in the evolving business district of Holešovice. The premises offer affordable office spaces for start- ups, meeting rooms for flexible rent and a large conference space.

The centre is planning to open a one stop-shop for companies from Prague and abroad to offer advice and support on setting up a business in Prague.

Financial support and access to investors & accelerators

Two start-up incubators are run under Prague City Hall – Prague Startup Centre and ESA BIC, which focus on space technologies. Both incubators offer, in addition to financial incentives, the coaching and mentoring support in various topics, mediate the contact with investors and help SMEs to succeed.

The Prague Vouchers programme helps start-ups to get new websites or new logo, and can lead to enrolment in an accelerator or a booth in a technological fair abroad.

How to set up a business: a quickfire guide

What are my options?

The most common legal form for Czech start-ups and SMEs is the limited liability company (společnost s ručením omezeným; or “LLC”).

Among the advantages of an LLC is the very low minimum share capital contribution requirement of just CZK 1 (approx. €0.04), with 30% to be paid in upon formation.

A higher contribution may be determined and recorded in the foundation deed (in the case of a one-member company) or articles of association (in the case of a company with multiple members). It is also recommended that your company has a share capital of at least CZK 100,000 (approx. €3,900), which is standard in the Czech market and makes the company appear more credible.

What do I need to set up a company?

The following steps are required to set up an LLC:

(i) execution of a foundation deed or articles of association in the form of a Czech notarial deed; (ii) opening of a bank account; (iii) payment of the share capital and issuance of a bank confirmation that the share capital has been paid up; (iv) obtaining consent from the owner of the real estate where the company will have its registered office (if the company is not the owner); (v) obtaining a trade licence; and (vi) filing for registration in the Czech Commercial Register.

Upon registration, the LLC is established. Registration usually takes two to three weeks from the submission of a complete filing. Czech banks conduct a thorough KYC (know-your-customer) check before they open a bank account. This should be factored into the timing.

The same set of rules applies to foreign entrepreneurs when it comes to the foundation of an LLC. Practice has shown, however, that logistics as well as the opening of a bank account are sometimes practical bottlenecks for foreign founders. In addition, licensing and trade law requirements may impose conditions on foreign founders.

How much does it cost?

The cost and timing for establishing an LLC depend mainly on the complexity of the intended corporate governance rules and the number of shareholders. Legal fees typically range between €2,500 and €3,500 (net). Special legal packages are available for start-up founders. Founders must budget an additional €500 for court and notary fees.

Tax rates

The corporate income tax rate for LLCs is 19%. Capital gains (dividends and proceeds from the sale of the LLC) will generally be taxed at a rate of 15%. Exemptions and double-taxation issues should be considered.

After the registration of the LLC, further steps may be needed such as: (i) tax registration and a request for issuance of a tax identification code / tax number / VAT number; (ii) registration of the LLC in the Czech Beneficial Owner Register; and (iii) registration at the social security office (if the company has employees).

LLCs in the Czech Republic are subject to very strict capital maintenance rules that essentially limit payments by the LLC to its shareholders to dividends and arm’s length transactions (the consequences of a violation may be that transactions are declared null and void, at least partly; there will also be claw-back risk, liability of management and potential tax liabilities).

The transfer of shares in an LLC (for example, in the course of an investment or exit, including call-and-put options) requires the drawing up of a share transfer agreement with notarised signatures.

Legal contact

Vladimír Čížek

Schonherr

CZ-110 00 Prague 1, Jindřišská 16