Cities of Innovation: Bilbao

Key indicators

ICT Infrastructure

Business upload broadband speed (Mbps)

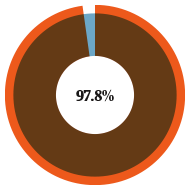

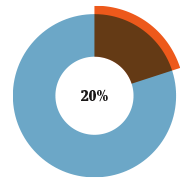

Company internet coverage 2017

— Large companies can connect at 100 Mbps, Households at 30 Mbps — 97.8% of all companies had an internet connection in 2017 — 1,000 free WIFI street hotspots in all districts and almost all municipal buildings

Local, national and international transport links

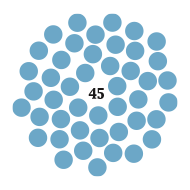

Direct flights (Bilbao international airport)

Flight destinations (5.1 million passengers)

— High speed train to be operational in 2023 connecting to Madrid, Lisbon and Paris — Bilbao Harbour is one of the most important logistics centres of the Atlantic route with 34 million tonnes transported between over 800 harbours to which Bilbao is connected

University links and access to talent

QS World University ranking (University of the Basque Country)

Training population with degree

— 17,950 students in 4 main universities including 22 faculties offering 123 degrees, masters and PhD studies (year 2016-2017) — 69 training centers with 165 different professional training programmes

Costs and availability of workspace

Co-working average costs

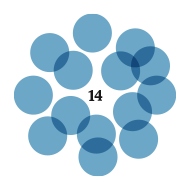

Co-working spaces

— Workspace rates (m2/month): · €8-28 in the CBD area · €9-13 elsewhere — 14 co-working spaces including 6 incubators

City support for start-ups and SMEs

Awareness programmes to promote entrepreneurial culture

Entrepreneurship initiatives

— Three initiatives to promote entrepreneurship in universities and professional training: Deusto Employment Forum, digital entrepreneurship contests and the THINK Big business ideas contest — Activities to boost the community of local entrepreneurs such as the revitalisation of meeting spaces

Financial support and access to investors & accelerators

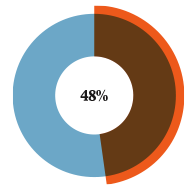

Corporate tax for SMEs

Acceleration programme (promoted by the Basque Government)

— Basque administrations work to support SMEs in search for spaces, funding, tax matters, capture of talent and strategical aspects — Bizkaia Open Future: Initiative promoted by the Regional Council of Bizkaia and Telefónica to support the transition to Industry 4.0.

How to set up a business: a quickfire guide

What are my options?

The choice of entity for entrepreneurs or subsidiaries of foreign companies that wish to operate in Spain with limited liability for shareholders is either the Limited Liability Company (SL) or a Public Limited Company (SA).

Requirements/steps for incorporation for both are:

a. Apply for a corporate name for the new company.

b. Open a bank account for the new company.

c. Draft by-laws.

d. Appoint Directors.

e. Sign the incorporation before a Public Notary.

f. Register the new company with the Commercial Registry.

g. Obtain regulatory approvals for certain activities if needed.

h. Grant a Power of Attorney to local legal advisors to carry out the necessary steps if the shareholders are not going to be present at the incorporation.

What do I need to set up a company?

— The minimum share capital required for an SL is €3,000 and for an SA it is €60,000.

— Public Notary and Commercial Register fees are between €500 and €1,000 (and accounting and legal advisory fees will be charged on top).

Foreign individuals/directors must obtain a foreign identification number (known as a NIE) and foreign companies seeking to set up a branch must get a local fiscal number (a NIF).

Time needed for the registration procedure

This depends on the structure chosen. An estimated timescale would be as follows:

a. 15-30 calendar days to obtain a NIE/NIF.

b. 7-10 working days for the company to be incorporated before a Public Notary.

c. 15 working days (from incorporation) for registration although the company can trade as soon as it is incorporated.

Entrepreneurs need to be aware of the following requirements after registration:

a. Accounting and payroll obligations.

b. Tax procedures (VAT and Tax on Economic Activities).

c. Occupational procedures (eg registration of the company for social security and employee insurance).

In addition, the company founders may have to file a declaration of ultimate beneficial owner (25% of share capital) at incorporation and a declaration relating to the origin of funds may be required depending on the country from where the company is funded.

Tax rates

A reduced tax rate of 15% is applicable for start-ups if they meet certain conditions.Rousaud Costas Duran

Legal contact

Rousaud Costas Duran

RCD

Escoles Pies, 102 08017 Barcelona