Cities of Innovation: Antwerp

Key indicators

ICT Infrastructure

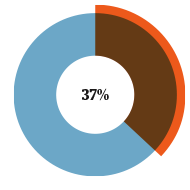

IPv6 Internet traffic

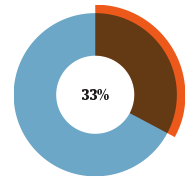

Average broadband speed (Mbps)

— 1st innovator in the process of moving to IPv6

Local, national and international transport links

Airport (25 million passengers per year)

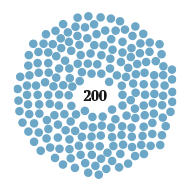

Flight destinations

— 70 train destinations in 19 countries — High-speed train connects Antwerp to Paris in 2h as well as the main european international airports — 2nd largest port of Europe and 11th in the world

University links and access to talent

QS World University ranking (University of Antwerp)

Higher education graduates (aged25-64)

— 40,000 students — Key research domains are in the fields of harbour & logistics, sustainability, science & engineering, and medical sciences — 1,700 creative entrepreneurs

Costs and availability of workspace

Innovation spaces

Workspace rent

— Prices for average rent of office is €145 m2/year — 2 brand new innovative spaces: BlueGate Antwerp (a business park focused on the circular economy), and BlueHealth (focused on e-health initiatives)

City support for start-ups and SMEs

Efficiency of administrative services world ranking

Initiatives

— Flanders Innovation & Entrepreneurship Business Advisors support entrepreneurs in achieving their innovative plans, growth ambitions or business transformation. They also offer support for training, advice, investments and research & development

Financial support and access to investors & accelerators

Subsidies

Tax shelter initiatives

— Three tax shelter initiatives: In return for direct investment, an investor is granted tax relief on their personal income tax equal to 30% or 45% of the investment. The applicable rate depends on the size of a start-up, 30% for SME’s and 45% for “very small enterprises”

How to set up a business: a quickfire guide

What are my options?

The three most common types of companies in Belgium are: (1) a public limited liability company (in Dutch: “Naamloze vennootschap” / in French: “Société anonyme”) (hereafter: “NV/SA”); (2) a private limited liability company (in Dutch: “Besloten vennootschap met beperkte aansprakelijkheid” / in French: “Société privée à responsabilité limitée”) (hereafter: “BVBA/SPRL”); and (3) a cooperative company (in Dutch: “Coöperatieve vennootschap” / in French: “Société coopérative”) (hereafter: “CV/ SC”). Different levels of capital contribution are required depending on the type of vehicle chosen.

Public limited liability company

The NV/SA is usually chosen as the corporate form for large companies, but also for the establishment of some SMEs. It mainly focuses on the capital contribution of the shareholders, making it a company with a less familial nature. The liability of the shareholders is limited to their contribution.

This type of company must be established by at least two founders and must be incorporated by notarial deed. The share capital of the company should amount to at least 61,500, which has to be fully paid up at the time of incorporation.

Private limited liability company

The BVBA/SPRL is in principle incorporated by at least two founders. An exception is made for the one-person BVBA/SPRL. The BVBA/SPRL, like the NV/SA, must be incorporated by notarial deed.

The minimum share capital of a BVBA/SPRL amounts to €18,550, which has to be paid in to the amount of €6,200 in the situation where it is incorporated by two founders. The minimum share capital of a one-person BVBA/SPRL is €12,400 and this must be paid in at the time of incorporation.

Cooperative company

The CV/SC is a company whose shareholders work towards common objectives and share common values. The main characteristic of the CV/SC in Belgium is that it has a variable number of shareholders and a variable capital, alongside its fixed capital.

The constitution of the CV/SC always requires three founders. Failure to comply with this obligation may result in the nullity of the deed of incorporation. The other incorporation formalities depend on the type of CV/SC one would like to establish.

A CV/SC with limited liability must be incorporated by notarial deed. The articles of association for this type of company stipulate that there must a “fixed part” of the share capital, the amount of which must not be less than €18,550, and of which €6,200 must be fully paid in at the time of incorporation.

A CV/SC with unlimited liability on the other hand can be established by private agreement. The incorporation of a CV/SC with unlimited liability does not require a minimum capital. However, it is the responsibility of the founders to provide the company with sufficient funds to carry out its activities.

What do I need to set up a company?

Each of the above companies can be incorporated either via a contribution in cash or in kind.

Incorporation via a contribution in cash requires an address in Belgium for the registered office of the company. Furthermore, a business plan will have to be drafted containing detailed information about the financial situation of the company. The founders will also have to open a blocked bank account in the name of the company, where the capital of the company must be paid in.

In the event of a contribution in kind, the above requirements will be completed once the assets provided by the founders have been evaluated by an auditor, who is obliged to draft a report with an explanation of the valuation methods used. The founders of the company are obliged to draft a special report in which they must describe and evaluate the assets.

The setting up on any of the options above takes approximately 2 to 3 weeks, depending on certain formalities, such as the opening of the bank account in Belgium.

Tax rates

With the introduction of the Corporate Income Tax Reform Act (dd. December 25, 2017), the corporate income tax rate has been reduced from 33.99% to 29.58% for assessment years 2019 and 2020, and it will fall to 25% for 2021. The first €100,000 of taxable income of SMEs enjoys a lower tax rate of 20.4% (reduced to 20% from 2021) provided that certain conditions have been met.

Belgian corporate income tax is paid via advance tax payments. Companies not making such advance payments are subject to a surcharge.

Legal contact

Pierre Willemart and Elise Theys

Koan Law Firm

Ch. de la Hulpe 166 Terhulpsesteenweg B-1170 Brussels Belgium