Post-COVID metropolis and Uber

17 December 2021

As the world considers its post-pandemic future, changes in cities, travel, mobility, work, and consumer preferences are beginning to emerge, even as the reality of new variants and pandemic management remains ongoing. To understand the nuances of some of these trends in urban development and transportation, Uber commissioned architecture and design firm WXY in early 2021 for a Future of Cities research initiative. Together, the team examined Uber Rides data from September 2019 and March 2021, comparing travel patterns in 4 cities and towns in the US (New York City, Phoenix, Cincinnati, and Waco) and 4 overseas (Sao Paulo, London, Johannesburg, and Hong Kong) to better understand how people have been using ridehail and whether there are any indications of changes that will endure.

A few notable findings from the final report emerged:

- When cities thrive, ridehail thrives. There has been some speculation about the kinds of cities where ridehailing can play a positive role. The research showed that when local economies are active and diverse, where there is a lot to do and a variety of destinations to visit, and where public transport systems are robust, people are most likely to use Uber to get around.

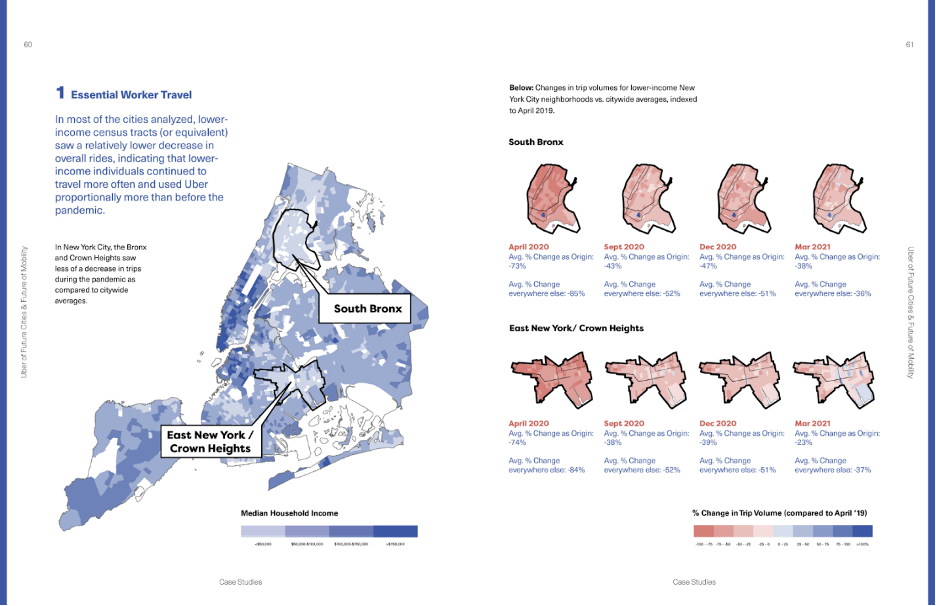

- During the pandemic, ridehail continued serving the needs of low-income riders. While ride volumes during the height of the pandemic decreased, people living in low-income areas, particularly those with few mobility options, were using Uber more frequently than people with access to a variety of ways to get around. This shows that Uber has served as a fundamental mode of transportation for essential workers during the pandemic, and it will continue to do so as cities continue to recover from and manage COVID.

- Ridehail supplements transit for essential work; it is “mobility insurance.” Unsurprisingly, essential work destinations were more common destinations under shelter-in-place policies, and Uber acted as “mobility insurance” for people getting to essential jobs when they could or would not ride transit. Similarly, the data reveals that people relied on Uber to visit parks and other open spaces during lockdown periods when they may not have had other options.

- Potential for mixed uses everywhere. While some uncertainty remains about the recovery of central business districts across all 8 cities, the Rides data reveals greater demand for travel to mixed-use districts—those with a mix of residential, retail, and office uses. In both low- and high-density areas, localised nodes—areas with a diversity of amenities in close proximity to one another—emerged as popular destinations. This was particularly interesting in the US and Canadian contexts, where there tends to be weak land use policy for these kinds of developments, and speaks to a potential growth in demand for more mixed-use, multi-unit dwellings in lower-density areas in the future.

Mobility for lower-income communities

Uber served as a form of mobility insurance for travellers with limited transportation options. While trips decreased significantly in most areas, low-income households appeared to use Uber more consistently than other income groups throughout the pandemic. And in some cases, areas with lots of essential jobs, such as distribution centers or hospitals, became some of the platform’s biggest local trip generators. These findings align with pre-COVID studies about mobility choices by lower-income communities, as well as a survey of travel choices during the pandemic, that show how ridehailing serves low-income communities.

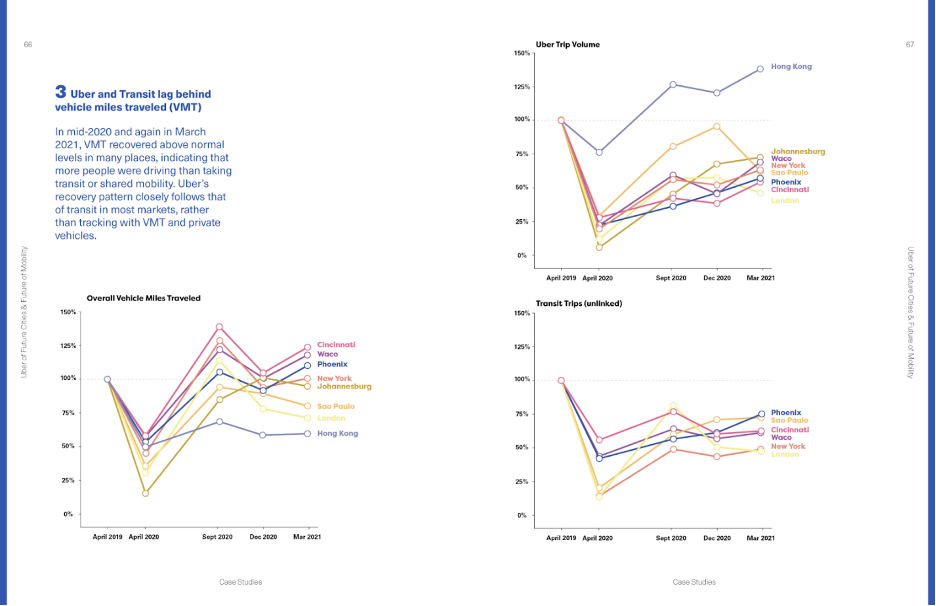

Car ownership as the shared competitor

Data reveals that Uber rides and transit use are following the same recovery trendline, while private car travel is rebounding more quickly. Specifically, even as cities continue to reopen, both transit ridership and Uber ridehail usage remain at 50 to 70 percent of pre-pandemic (April 2019) levels in nearly every city studied. Meanwhile, overall vehicle miles travelled from private car use grew to pre-COVID levels in most cities and even reached new highs in some. This corroborates a growing body of evidence that Uber and transit are used by the same multimodal riders and suggests that ridehailing may support general transit use, even if it does not always serve as a first- and last-mile trip. It also correlates with data showing that private car driving continues to dominate travel choices and actually grew during the pandemic.

Conclusion

Even as cities continue their long march toward recovery, a great deal of uncertainty remains regarding the shape that recovery may take. But Uber hopes that there will be a concerted effort to address the stark need for greater access with solutions that also address climate and equity challenges. On-demand, shared mobility has provided an essential service during the pandemic, especially for people who have comparatively limited options, to increase mobility access. As cities around the world contend with ongoing management of COVID, there’s potential for ridehailing to continue to have outsized impact in building back better.