Cities of Innovation: Warsaw

Key indicators

ICT Infrastructure

Average broadband speed (Mbps)

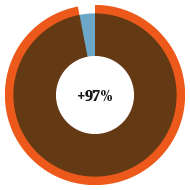

SME broadband coverage

— HOT SPOT UM-Warsaw offers free wireless internet 24h a day with a range of approximately 300-400 m — Warszawski Hot Spot offers an internet connection with a maximum speed of 1 Mbs which lasts up to 45 minutes. A new session can be started after a delay of 15 minutes

Local, national and international transport links

Airport passengers

Non-stop flight destinations

— Chopin airport is a 10 km, 20-25 minute journey away — Warsaw Modlin Airport is located around 35 km north-west of the city centre

University links and access to talent

QS World University ranking (Warsaw University)

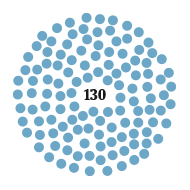

Students

— 77 universities — Academic incubators are present in 23 Polish cities, and 5 Warsaw universities — MatchIT is a startup hackathon at the University of Warsaw — 150 research institutions

Costs and availability of workspace

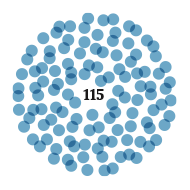

Co-working spaces

Average city centre office rent

— Co-working space will increase to 140,000 m2 by 2020 — Construction has begun on the Varso office building (HB Reavis) which will be the highest building in the European Union (310 m)

City support for start-ups and SMEs

Start-up programme

Business events

— #Warszawa 2030 Strategy was created to attract Warsaw’s talents and leaders and generate innovation — The Poland Prize combines the idea of acceleration and soft landing for start-ups with a special emphasis on preparing foreign startups to operate in Poland

Financial support and access to investors & accelerators

EU funded project (Warsaw capital of an ambitious business)

Regional funds

— The City of Warsaw has financed five acceleration programs since 2015, in which comprehensive business support of mentors and advisers is offered — The Polish Agency for Enterprise Development is involved with the management of projects imple- mented with EU structural funds

How to set up a business: a quickfire guide

What are my options?

In Poland, a limited liability company (Polish: spółka z ograniczoną odpowiedzialnością, sp. z o.o.; or “LLC”) is the most popular and common legal form for start-ups and SMEs.

The minimum share capital for a Polish LLC is PLN 5,000.00 (approx. €1,160), where the nominal value of each share cannot be lower than PLN 50.00 (approx. €11.60).

LLCs can be established either in a traditional way, i.e. by signing a notarial deed or via the Internet – by using a special dedicated portal called “S24”.

Depending on how the company is established, the capital must be paid in before the motion to register the LLC is submitted (traditional way) or within seven days after the company is registered (online registration). Once paid in, the funds are the LLC’s property and can be spent in any way compliant with the company’s Articles of Association.

What do I need to set up a company?

Regardless of how the company is established, the following steps and documents are required:

(i) execution of the Articles of Association (in the form of a Polish notarial deed or using a special template when registering the company online); (ii) opening a bank account (in practice it may be done after the company is established); (iii) preparing and signing documents such as a list of shareholders, list of entities/people entitled to appoint members of the management board etc.; and (iv) filing in the commercial register regarding the formation.

The average time needed to establish and register a company in Poland is around one month (or more) when the LLC is established in a traditional way, or one to two working days if registering the LLC online.

Depending on how the company is created, the costs and timing for its establishment differ. Entrepreneurs wishing to register their LLC in a traditional way should be prepared for notarial deed costs varying from PLN 160 (approx. €37) to a few thousand PLN (depending on the share capital). Other than that, the court fees are PLN 600 (approx. €139). If they set up the

LLC via the Internet, entrepreneurs will avoid the notarial fees and the court fees which amount to PLN 350 (approx. €81).

When it comes to the formal set-up requirements, generally they are the same regardless of whether the LLC is established by a domestic or foreign entrepreneur. However, there are categories of foreigners (e.g. from outside the EU), who are subject to additional restrictions when setting up other types of companies in Poland. Additional requirements with respect to ownership/perpetual usufruct of real estate in Poland may apply.

As practice shows, sometimes logistics, signing documents in time, opening a bank account etc., create difficulties for foreigners. Using the S24 portal to establish a company is getting more and more popular for foreigners, as it does not require them to be in Poland at the time of establishment.

Generally, it is necessary to conduct full bookkeeping and submit financial statements to the registry court each year.

The fact of registering an LLC in the registry court must be noted at the tax office as soon as possible, and a request for issuance of a tax identification code/tax number/VAT number must be submitted.

As of 13 October 2019, the Polish Ultimate Beneficial Owner Register will be created, and every LLC will be obliged to submit relevant information. Currently, information related to the ultimate beneficial owner is only required with respect to e.g. financial activities (opening a bank account etc).

Tax rates

Civil transactions tax differs depending on the share capital of the LLC. The minimum share capital of PLN 5,000.00 will result in a tax charge of PLN 20-25 (around €5). The applicable corporate income tax rate is 19%. Exemptions and double-taxation issues with respect to dividends should be considered.

Legal contact

Pawel Halwa

Schoenherr

PL-00-107 Warsaw, ul. Próżna 9