Cities of Innovation: Krakow

Key indicators

ICT Infrastructure

Average broadband speed (Mbps)

Broadband speed (Mbps)

Local, national and international transport links

Flight destinations (5.86 million passengers in 2017)

Hourly train to Warsaw

— A4 motorway connects the borders of Germany and Ukraine — A1 motorway connects Tricity to the border of the Czech Republic. — The express road S7 being built in the north of the city will ultimately connect Krakow, Warsaw and Gdansk

University links and access to talent

QS World University ranking (AGH University of Science and Technology)

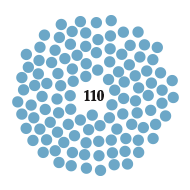

Students

— Krakow is home to the branch of the Polish Academy of Sciences, the seat of the National Science Centre and the fastest supercomputer in Poland, the Prometheus at AGH University — 22 higher education institutions, 160,675 students, including 8,000 specializing in IT

Costs and availability of workspace

Average office rent

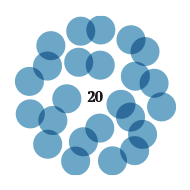

Co-working spaces

— Total office space 1.1 million m2 — 190,000 m2 of offices built in 2017

City support for start-ups and SMEs

Business support programmes

Major conferences

— Business support programmes: · Krakow Programme for Supporting Entrepreneurship and Economic Development of the City · Entrepreneurship service point — 2 major Hackathons, 1 within StartKRKup event called HackYeah and Smogathon

Financial support and access to investors & accelerators

Playpark Krakow

Startup promotion projects

— Competitions for NGOs supporting business which promote innovation/cooperation — 2 Startup promotion projects: · Growing Internationally - Krakow’s Economy on the Rise · CERIecon: CENTRAL EUROPE Regional Innovation Ecosystems Network

How to set up a business: a quickfire guide

What are my options?

In Poland, a limited liability company (Polish: spółka z ograniczoną odpowiedzialnością, sp. z o.o.; or “LLC”) is the most popular and common legal form for start-ups and SMEs.

The minimum share capital for a Polish LLC is PLN 5,000.00 (approx. €1,160), where the nominal value of each share cannot be lower than PLN 50.00 (approx. €11.60).

LLCs can be established either in a traditional way, i.e. by signing a notarial deed or via the Internet – by using a special dedicated portal called “S24”.

Depending on how the company is established, the capital must be paid in before the motion to register the LLC is submitted (traditional way) or within seven days after the company is registered (online registration). Once paid in, the funds are the LLC’s property and can be spent in any way compliant with the company’s Articles of Association.

What do I need to set up a company?

Regardless of how the company is established, the following steps and documents are required:

(i) execution of the Articles of Association (in the form of a Polish notarial deed or using a special template when registering the company online); (ii) opening a bank account (in practice it may be done after the company is established); (iii) preparing and signing documents such as a list of shareholders, list of entities/people entitled to appoint members of the management board etc.; and (iv) filing in the commercial register regarding the formation.

The average time needed to establish and register a company in Poland is around one month (or more) when the LLC is established in a traditional way, or one to two working days if registering the LLC online.

Depending on how the company is created, the costs and timing for its establishment differ. Entrepreneurs wishing to register their LLC in a traditional way should be prepared for notarial deed costs varying from PLN 160 (approx. €37) to a few thousand PLN (depending on the share capital). Other than that, the court fees are PLN 600 (approx. €139). If they set up the

LLC via the Internet, entrepreneurs will avoid the notarial fees and the court fees which amount to PLN 350 (approx. €81).

When it comes to the formal set-up requirements, generally they are the same regardless of whether the LLC is established by a domestic or foreign entrepreneur. However, there are categories of foreigners (e.g. from outside the EU), who are subject to additional restrictions when setting up other types of companies in Poland. Additional requirements with respect to ownership/perpetual usufruct of real estate in Poland may apply.

As practice shows, sometimes logistics, signing documents in time, opening a bank account etc., create difficulties for foreigners. Using the S24 portal to establish a company is getting more and more popular for foreigners, as it does not require them to be in Poland at the time of establishment.

Generally, it is necessary to conduct full bookkeeping and submit financial statements to the registry court each year.

The fact of registering an LLC in the registry court must be noted at the tax office as soon as possible, and a request for issuance of a tax identification code/tax number/VAT number must be submitted.

As of 13 October 2019, the Polish Ultimate Beneficial Owner Register will be created, and every LLC will be obliged to submit relevant information. Currently, information related to the ultimate beneficial owner is only required with respect to e.g. financial activities (opening a bank account etc).

Tax rates

Civil transactions tax differs depending on the share capital of the LLC. The minimum share capital of PLN 5,000.00 will result in a tax charge of PLN 20-25 (around €5). The applicable corporate income tax rate is 19%. Exemptions and double-taxation issues with respect to dividends should be considered.

Legal contact

Pawel Halwa

Schoenherr

PL-00-107 Warsaw, ul. Próżna 9