Cities of Innovation: Budapest

Key indicators

ICT Infrastructure

Ultrafast broadband coverage

Average broadband speed (Mbps)

— Hungary intends to be among the first countries in the world to introduce 5G — Fixed broadband coverage: 95% 4G coverage : 91% — 29.8% of homes subscribe to faster than 100 Mbps Internet, which is the 7th highest ratio in the EU

Local, national and international transport links

Direct flights from BUD (14.9 million passengers/year)

Best Airport: Eastern Europe (Skytrax)

— Budapest Airport (BUD) had a 14.5% increase in passengers and a 13.4% increase in cargo volume in 2017 — Hungary is located at the crossroads of three TEN-T Core Network Corridors, granting easy access to the 500 million consumer market of the European Union

University links and access to talent

QS World University ranking [Budapest University of Technology and Economics (BME)]

Tertiary-education students (2017-2018)

— The focus of the Center for University-Industry Cooperation (FIEK) launched by BME is to encourage synergies between different research areas — 19,951 postgraduates (MA/MSc), and 3,929 PhDs — 43 tertiary-education institutions

Costs and availability of workspace

Class A offices average rent

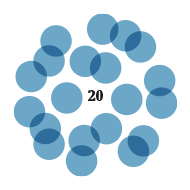

Co-working spaces

— Office vacancy rate is 6.4% — The total modern office stock in Budapest in 2018 Q3 added up to 3,587,290 m2 — Co-working spaces include: Kaptar, Kubik, Loffice, Greenspaces and Impact Hub

City support for start-ups and SMEs

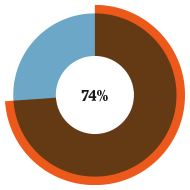

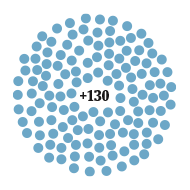

Budapest Enterprise Agency (BEA) event participants since 2015

BEA organized events since 2015

— Budapest Enterprise Agency (BEA) is a Business Innovation Center founded by the Budapest City Council for the development and promotion of micro, small and medium enterprises — 117 startup businesses with 32 delegations have showcased themselves abroad

Financial support and access to investors & accelerators

Support programmes

MNC accelerator programmes

— BEA’s Budapest Microloans Scheme offers loans and revolving credit at discounted and fixed interest rates and, within it, there is also an interest subsidy scheme called the Interest Subsidy Scheme for Microenterprises in District VIII

How to set up a business: a quickfire guide

What are my options?

The most popular form of company in Hungary is the KFT (or Limited Liability Company, in Hungarian: korlátolt felelősségű társaság), due to the limited liability it offers founders and because of its simple organisational structure. Limited liability means that members are only liable to provide their financial contribution to the registered capital, and are not directly liable for the debts of the company.

There are no restrictions on the number of founders, nor on their citizenship – a KFT can even be founded by one person.

What do I need to set up a company?

After deciding on the specifics (company name, registered office, registered capital, type of business activity, composition of management, representation rights), you need to hire a Hungarian attorney-at-law (or notary) to help with the preparation of documents and the online registration at the Court of Registration.

In the case where any of the members or the directors has no permanent address in Hungary, a delivery agent needs to be appointed as part of the foundation documents. It is common practice to appoint an attorney as the delivery agent to prepare and countersign the company documents. A delivery agent makes sure that the official documents issued by the Court and other authorities get forwarded to the addressee.

The managing director also needs to open a bank account in Hungary for the new company (costs vary) within eight days of incorporation. This should only take a couple of hours with the selected bank.

The time needed for the preparation of the corporate documents depends on how much information you can readily provide to the attorney-at-law preparing your documents. If you are already set on all the above, the documents can be prepared for signing within one or two business days.

In case you need to visit a notary locally and send the notarised (and Apostilled, if necessary) foundation documents to Hungary by courier, the process would potentially take an extra day or two.

The official part of the process should in general take no longer than two business days, from filing for registration to receiving the court order. Once the tax ID is issued, you can start your operations right away.

How much does it cost?

There are no statutory incorporation fees. However, if you wish to make changes to a registered company’s corporate documents any time after its incorporation, fees in total of HUF 18,000 (app. €60) will apply. Related attorney fees for assistance with the establishment of a simplified, by-template company set-up are subject to agreement with legal counsel.

The minimum registered capital required is HUF 3,000,000 (€10,000) which does not need to be all cash or paid in right away.

Tax rates

After filing at the Court of Registration, the Court will inform the National Tax Authority. The Tax Authority then issues a tax ID for the company within one business day. If after examining the founding members’ and the managing directors’ background the Tax Authority refuses to issue a tax ID, the Court of Registration will suspend the registration process pending further investigation.

If everything is found to be in order, the Court will issue a court order proclaiming the incorporation of the company.

Corporate tax in Hungary is the lowest in Europe at 9%, while local business tax is capped at 2% of total net sales revenue.

Legal contact

Zoltan Tenk

Tenk

TENK Law Firm H-1124 Budapest, Csörsz u. 49-51