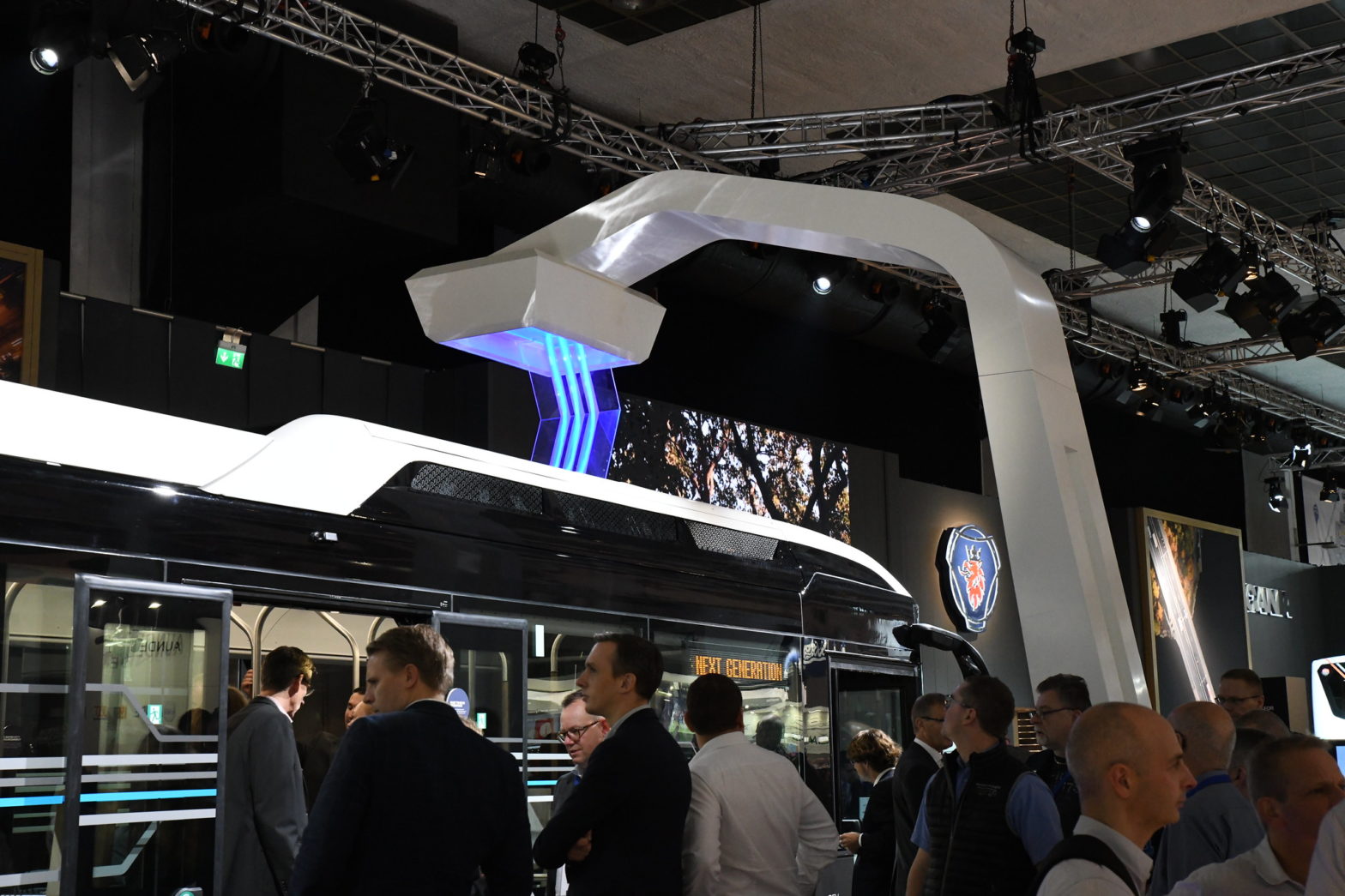

Photo: Leonovo | Dreamstime.com

How contactless travel will help transform urban mobility in a post-COVID world

20 April 2021

COVID-19 has had a massive impact on cities and public transportation companies across the globe as they work to deliver safe, reliable, and inclusive methods of transport. Nick Mackie, Vice President and Global Head of Urban Mobility, Visa, explains why deploying contactless payment technology where riders simply tap to pay — rapidly, and at scale — is critical in a world where no-contact experiences are here to stay.

Pre-COVID, mass transit systems sustainably served millions of people who rely on subways, rail or buses every day. The impacts of the pandemic have been a shock to the system, no doubt. But as we emerge into our new global reality, a growing wave of contactless transit payment adoption will help integrate ridership more seamlessly and safely, catering to new routines of daily life and increasing operational savings and efficiencies for the operators, among other tangible benefits.

With heightened consumer uncertainty over commuting and the challenges in practising safe social-distancing on journeys, so-called ‘open loop’ contactless travel is helping to re-shape the transit experience, enabling riders to access transit systems using something they already own – whether a credit or debit card, smartwatch or smartphone – without any need to obtain, download or load funds on to a transit fare card in advance.

Air travel and transport ridership eventually recovered from catastrophic events such as the attacks of 9/11 and the 2003 SARS epidemic. But recent surveys show that the road to a post-COVID normal remains more fraught. Governments and transit agencies must plan for longer-term recovery while trying to model the trajectory of work-from-home preferences and policies that could persist for years.

Last March, 48 percent of Americans said that riding public transit poses a high health risk due to the coronavirus. Now, though there are indications that cities and transport networks can get back up and running safely. Experts believe that much of this is the result of improved adherence to public health measures, such as social distancing and wearing masks. Many cities around the world that have seen significant return to public transport have yet to experience outbreaks that can be traced to public transportation – including in Hong Kong, Beijing, Tokyo, Paris, and Berlin.

As mobility system players adapt, a report from the International Association of Public Transport (UITP) and consultancy Arthur D. Little identified “game changers” it believes will be critical – including system-level thinking, public-private partnerships and accelerating digitalisation to proactively engage with users.

Finding opportunity in adversity

The unprecedented declines in public transport usage have provided an opportunity – however unwelcome – for transportation agencies to make long-planned repairs and upgrades. To help pay for these projects, agencies are tapping both emergency access and recovery funds. US transit agencies received US$25 billion through the Coronavirus Recovery Bill passed by Congress last March, for example.

Such investments represent both the indispensable nature of public transportation and the beginnings of what leading transportation experts see as a re-imagining of the entire experience — systems that are more flexible, equitable, and resilient.

This movement is already under way. Many agencies now view touch-free payment experiences — enabled by contactless payment technology as well as other means — as no longer a nice to have, but a must-have for post-pandemic recovery. The New York City MTA, for example, recently completed its contactless payment rollout to all subways and buses.

Getting the most from contactless travel

Contactless payments play a key role in building public trust regarding passenger health and safety, and critically, the safety of public transport workers. In fact, 65 percent of surveyed consumers would prefer to use contactless payments as much as, or even more than, they are currently.

Following is a closer look at just a few ways contactless payments will help transform transit now, and in a post-COVID world:

- Fare flexibility for new workplace norms. While many workers will eventually return to the office, many companies are pivoting to permanent hybrid working models, and an increase in remote working is likely to persist. In the context of this new normal, open loop, pay-as-you-go contactless payments provide commuters with the flexibility to pay for transport when and as they need it. For less consistent commuters, many weekly, monthly or annual passes may no longer have the appeal they had pre-pandemic. Meanwhile, contactless fare-capping rules allow riders to get the best fare without planning or making a decision to buy a daily or weekly ticket in advance.

- Digital solutions increase operational savings. In shifting away from traditional forms of ticketing and legacy (or proprietary) systems, contactless pay-as-you-go travel can provide savings and help operators focus on higher priorities such as rider safety and satisfaction. According to Transport for London (TfL), for example, as much as 14 pence in every pound collected is spent on operating the London Oyster payment system. By comparison, open loop can be operated for as less than 10 pence, or nearly a 30 percent cost savings.

- Improved security and privacy. Digital payments and ticketing can reduce fraud and secondary sales. The open-loop contactless system enables consumers to make payments with either EMV chip contactless cards or with digital wallets that can be used widely outside the transportation system. This system enhances the protection of customer payment card data and eliminates the need to pre-register, which is often necessary when using an app or closed-loop proprietary solutions.

- Tapping into data for better transport. The shift to digital ticketing and payments provides access to passenger data that can be used to optimise route scheduling and capacity planning. Real-time passenger counting data can also be integrated into apps that customers use to plan their travel; helping them avoid more congested times that may present social distancing challenges.

- Expanding financial inclusion. The transportation industry’s role in financial inclusion is as much about the structure of payment systems as it is about the cost of tickets. Digital payment systems accessing transportation networks can give under-banked people an entryway into broader financial services. For example, in Ho Chi Minh City, Vietnam, 5,000 Visa prepaid cards have been given to people near several bus stations in a university town as a way to get unbanked riders familiar with the system and to provide them an entry point to financial institutions. Digital payment systems also allow governments to interact with riders’ payment tools in order to subsidise fares for riders.

While the current climate is one of uncertainty, cities, government and private agencies will need to continue to adapt, innovate and create urban mobility systems that are more flexible, equitable, and sustainable as we all move forward together.

Image: Leonovo | Dreamstime.com